The clock is ticking on 2025, and if you’re like most commercial property managers, you’re staring at

a familiar challenge: aging equipment that’s been held together with emergency repairs, sky-high

maintenance costs, and no clear plan for what needs replacing in 2026. Sound familiar?

Here’s the harsh reality: those “quick fixes” and emergency service calls aren’t just eating into your

maintenance budget. They’re setting you up for catastrophic failures, unhappy tenants, and unplanned

capital expenditures that could derail your entire financial plan.

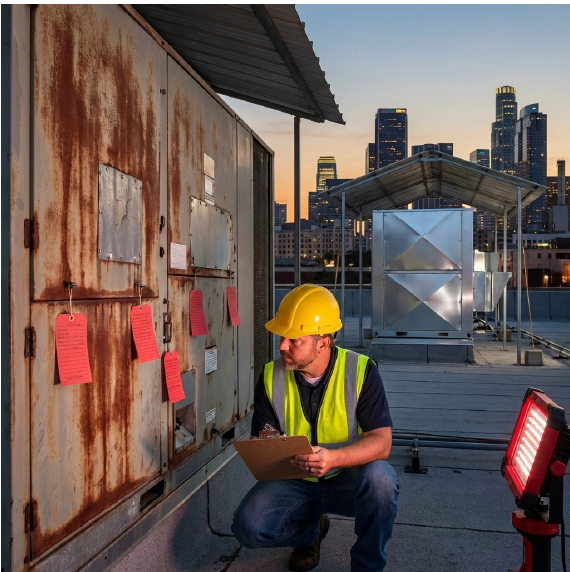

The Hidden Cost of Band-Aid Repairs

Your 15-year-old rooftop unit that “just needs another repair” isn’t saving you money: it’s bleeding

cash. When equipment reaches the end of its useful life, every service call becomes a gamble. Will this

repair buy you another year, or will you be calling for emergency service again next month?

Property managers who rely on reactive maintenance spend 3-5 times more on equipment costs over

the long term compared to those with strategic replacement plans. That aging boiler that’s been

“limping along” for three years might have cost you more in emergency repairs and energy inefficiency

than a complete replacement would have.

The data doesn’t lie: facilities with proactive capital planning see 40% fewer emergency service calls

and 25% lower overall maintenance costs. The question isn’t whether you can afford to replace aging

equipment: it’s whether you can afford not to.

Identifying Your “Problem Child” Assets

Before you can build an effective 2026 budget, you need to know which equipment is costing you the

most money. This isn’t guesswork: it’s data analysis.

Start by pulling your maintenance records for the past 18-24 months. Look for assets that show these

warning signs:

Chronic Service Issues:

• More than 3-4 service calls per year

• Recurring failures of the same components

• Increasing frequency of repairs over time

• Parts that are becoming difficult to source

Energy Inefficiency Indicators:

• Equipment consuming 20% more energy than manufacturer specifications

• Utility bills that spike during peak usage periods

• Complaints about hot/cold spots or poor performance

Tenant Impact Factors:

• Equipment failures that affect business operations

• Comfort complaints that correlate with specific systems

• Systems that require constant attention to maintain acceptable performance

Don’t just look at individual repair costs: calculate the total cost of ownership. That includes emergency

service calls, energy waste, tenant complaints, and the hidden cost of your time managing constant

problems.

The Repair vs. Replacement Decision Framework

How do you know when it’s time to stop throwing good money after bad? Use this proven decision

framework that successful property managers rely on:

The 50% Rule: If annual repair costs exceed 50% of replacement cost, it’s time to replace. For example,

if a new HVAC unit costs $10,000 and you’re spending more than $5,000 per year on repairs, replacement

is the financially sound choice.

Age and Efficiency Analysis: Equipment operating beyond 75% of its expected lifespan with declining

efficiency should be prioritized for replacement. A 20-year-old boiler that’s supposed to last 25

years but is operating at 60% efficiency is costing you money every day it runs.

Business Impact Assessment: Some equipment failures have catastrophic business consequences.

Restaurant refrigeration systems, data center cooling, or heating systems in senior housing facilities

should be replaced before failure, not after.

Building Your 1-3 Year Strategic Capital Plan

Smart property managers don’t just budget for next year: they plan for the next three years. This strategic approach prevents budget shock and allows you to time replacements for maximum efficiency and cost savings. Year 1 (2026) – Critical Replacements: • Equipment with imminent failure risk • Systems affecting life safety or critical operations • Assets where repair costs exceeded 40% of replacement value in 2025 Year 2 (2027) – Planned Upgrades: • Equipment approaching 80% of useful life • Systems with declining efficiency but still functional • Upgrades that will improve energy efficiency or tenant satisfaction Year 3 (2028) – Strategic Improvements: • Equipment replacement for efficiency gains • Technology upgrades that improve building performance • Systems that aren’t broken but could provide better value This phased approach allows you to spread capital expenditures across multiple years while ensuring you’re always ahead of equipment failures rather than reacting to them.Using Maintenance Data to Build Realistic Budgets

Your work order history is a goldmine of budgeting information: if you know how to use it. Here’s how to turn your maintenance data into accurate budget projections: Historical Cost Analysis: Calculate the average annual maintenance cost for each major system over the past 3 years. Factor in both routine maintenance and emergency repairs. This gives you a baseline for equipment that’s staying in service. Trend Analysis: Look for patterns in your data. Are certain types of equipment requiring more service each year? Are parts costs increasing due to obsolescence? These trends help you predict future costs and identify replacement priorities. Seasonal Planning: Review when most of your emergency calls occur. HVAC systems typically fail during peak summer and winter months. Plan major replacements during shoulder seasons when your systems aren’t under maximum stress.

Setting Realistic Budget Categories

Your 2026 facilities budget should include these essential categories:

Routine Maintenance (25-30% of total budget): Regular service, filter changes, routine inspections.

This is predictable spending that prevents bigger problems.

Emergency Repairs (15-20% of total budget): Even with good planning, unexpected failures will

happen. Budget realistically for these situations.

Capital Replacements (35-45% of total budget): Major equipment replacements based on your

strategic plan. This is where your data analysis pays off.

Energy Efficiency Upgrades (10-15% of total budget): Improvements that reduce operating costs

over time. These investments often pay for themselves through reduced utility bills.

Contingency Fund (5-10% of total budget): For truly unexpected situations or opportunities, such

as equipment recalls or unexpected rebate programs.

Implementation Strategy for 2026

Start implementing your capital plan now, before January arrives:

December 2025: Finalize your equipment assessment and confirm your 2026 replacement priorities.

Get quotes from qualified contractors for major projects.

January-February 2026: Execute critical replacements identified in your planning. Take advantage of

slower winter months for indoor work.

March-May 2026: Complete HVAC replacements before cooling season. This timing prevents emergency

situations during peak summer demand.

June-August 2026: Focus on routine maintenance and monitoring. Your new equipment should be

performing at peak efficiency.

September-November 2026: Complete heating system work before winter. Conduct annual planning

review and start preparing for 2027 budget cycle.

The Bottom Line: Strategic Planning Pays

Properties with strategic capital planning experience 60% fewer tenant complaints, 40% lower maintenance

costs, and significantly higher tenant retention rates. Your 2026 budget isn’t just about managing

expenses: it’s about positioning your property for long-term success.

Don’t let another year go by managing crisis after crisis. Use your maintenance data, apply proven

decision frameworks, and build a strategic capital plan that turns your “problem child” assets into reliable,

efficient systems that support your business goals.

Ready to transform your approach to facilities management? Contact our team to discuss how our

comprehensive HVAC-R maintenance services can help you implement a data-driven capital planning

strategy for 2026.

The time for reactive management is over. Strategic property managers who invest in proper planning

today will reap the benefits all year long( starting with their first day of 2026.)